Cara Kira OT? Guna CALCULATOR INI ( Update 2023 )

Lama dah saya sediakan artikel ni. Sejak 2017 lagi. Sekarang 2020, dan saya pun dah berhenti lama dah kerja kilang.

Artikel ni saya dah review berkali kali dah. Rasanya setiap tahun saya tukar untuk memenuhi permintaan di komen.

Antara yang biasa saya diminta ialah:

- untuk saya kirakan pula berapa gaji anda. Jenuh juga tu tau. berapa ramai yang minta.

- ada juga yang minta untuk tukarkan calculator yang saya buat dibawah kepada 8% kiraan untuk KWSP. Sebab pencarum KWSP ada dua jenis kan, sama ada bayaran 8 percent atau 11 percent.

- ada juga yang minta, kirakan gaji untuk berapa hari anda bekerja. Terutamanya bagi adik adik yang baru mula bekerja yang mungkin tak lengkap 1 bulan kerja. Mungkin mula masuk kerja 10hb kan. Jadi gaji mesti nak kira 10hb bukan 1hb.

Semua semua ni saya akan cuba bantu dibawah ya.

Kalau tahun 2017 dulu, memang saya ada kongsikan persamaan dalam excel di atas ni.

Memang tak berapa sempurna sebab anda terpaksa download. Dan anda juga terpaksa buka guna excel. Tapi apakan daya, skill buat website saya tak berapa canggih.

Tapi sekarang ni, Alhamdullillah, 2020 kita buat azam baru, selepas 2 hari 2 malam saya buat, akhirnya siap juga kalkulator kira gaji dan overtime anda dibawah ni.

Cuba try…

@media (max-width:480px){#cp_calculatedfieldsf_pform_1{min-height:4766px;}}@media (max-width:768px){#cp_calculatedfieldsf_pform_1{min-height:1817px;}}@media (max-width:1024px){#cp_calculatedfieldsf_pform_1{min-height:1884px;}}@media (min-width:1024px){#cp_calculatedfieldsf_pform_1{min-height:1822px;}}

form_structure_1=[[{"form_identifier":"","name":"fieldname7","shortlabel":"","index":0,"ftype":"fSectionBreak","userhelp":"","audiotutorial":"","userhelpTooltip":false,"tooltipIcon":false,"csslayout":"","title":"","fBuild":{},"parent":""},{"form_identifier":"","name":"fieldname21","shortlabel":"","index":1,"ftype":"fslider","userhelp":"","audiotutorial":"","userhelpTooltip":false,"tooltipIcon":false,"csslayout":"","title":"Jumlah hari bekerja dalam sebulan","exclude":false,"readonly":false,"predefined":"","predefinedMin":"","predefinedMax":"","predefinedClick":false,"size":"small","thousandSeparator":",","centSeparator":".","typeValues":false,"min":0,"max":"31","step":1,"marks":false,"divisions":5,"range":false,"logarithmic":false,"caption":"{0}","minCaption":"1","maxCaption":"31","fBuild":{},"parent":""},{"form_identifier":"","name":"fieldname22","shortlabel":"","index":2,"ftype":"fslider","userhelp":"","audiotutorial":"","userhelpTooltip":false,"tooltipIcon":false,"csslayout":"","title":"Jumlah jam bekerja dalam sehari","exclude":false,"readonly":false,"predefined":"","predefinedMin":"","predefinedMax":"","predefinedClick":false,"size":"small","thousandSeparator":",","centSeparator":".","typeValues":false,"min":0,"max":"12","step":1,"marks":false,"divisions":5,"range":false,"logarithmic":false,"caption":"{0}","minCaption":"1","maxCaption":"12","fBuild":{},"parent":""},{"form_identifier":"","name":"fieldname2","shortlabel":"","index":3,"ftype":"fnumber","userhelp":"","audiotutorial":"","userhelpTooltip":false,"tooltipIcon":false,"csslayout":"","title":"Basic Salary","predefined":"2500","predefinedClick":false,"required":false,"exclude":false,"readonly":false,"numberpad":false,"spinner":false,"size":"small","prefix":"","postfix":"","thousandSeparator":"","decimalSymbol":".","min":"","max":"","step":"","formatDynamically":false,"dformat":"digits","formats":["digits","number","percent"],"fBuild":{},"parent":""},{"form_identifier":"","name":"fieldname3","shortlabel":"","index":4,"ftype":"fnumber","userhelp":"","audiotutorial":"","userhelpTooltip":false,"tooltipIcon":false,"csslayout":"","title":"Total Allowance","predefined":"300","predefinedClick":false,"required":false,"exclude":false,"readonly":false,"numberpad":false,"spinner":false,"size":"small","prefix":"","postfix":"","thousandSeparator":"","decimalSymbol":".","min":"","max":"","step":"","formatDynamically":false,"dformat":"digits","formats":["digits","number","percent"],"fBuild":{},"parent":""},{"form_identifier":"","name":"fieldname5","shortlabel":"","index":5,"ftype":"fradio","userhelp":"","audiotutorial":"","userhelpTooltip":false,"tooltipIcon":false,"csslayout":"","title":"Pilih SKIM Pemotongan KWSP Anda","layout":"side_by_side","required":true,"exclude":false,"readonly":false,"toSubmit":"value","choiceSelected":"8% - 8%","showDep":false,"untickAccepted":true,"onoff":0,"choices":["Tiada","8%","11%"],"choicesVal":["0","0.08","0.11"],"choicesDep":[[],[],[]],"fBuild":{},"parent":""},{"form_identifier":"","name":"fieldname8","shortlabel":"","index":6,"ftype":"fSectionBreak","userhelp":"[Basic Salary + Allowance] - KWSP = ","audiotutorial":"","userhelpTooltip":false,"tooltipIcon":false,"csslayout":"","title":"Formula","fBuild":{},"parent":""},{"dependencies":[{"rule":"","complex":false,"fields":[""]}],"form_identifier":"","name":"fieldname1","shortlabel":"","index":7,"ftype":"fCalculated","userhelp":"","audiotutorial":"","userhelpTooltip":false,"tooltipIcon":false,"csslayout":"","title":"Monthly Salary ( Tiada OT )","predefined":"","required":false,"exclude":false,"size":"small","eq":"(fieldname2+fieldname3)-fieldname5*(fieldname2+fieldname3)","min":"","max":"","suffix":"","prefix":"","decimalsymbol":".","groupingsymbol":"","readonly":true,"currency":false,"noEvalIfManual":true,"formatDynamically":false,"dynamicEval":true,"hidefield":false,"validate":false,"fBuild":{},"parent":""},{"form_identifier":"","name":"fieldname4","shortlabel":"","index":8,"ftype":"fSectionBreak","userhelp":"","audiotutorial":"","userhelpTooltip":false,"tooltipIcon":false,"csslayout":"","title":"Pengiraan Jumlah OT ( auto calculate )","fBuild":{},"parent":""},{"dependencies":[{"rule":"","complex":false,"fields":[""]}],"form_identifier":"","name":"fieldname9","shortlabel":"","index":9,"ftype":"fCalculated","userhelp":"","audiotutorial":"","userhelpTooltip":false,"tooltipIcon":false,"csslayout":"","title":"Rate OT untuk 1.0","predefined":"","required":false,"exclude":false,"size":"small","eq":"(fieldname2\/fieldname21)\/fieldname22","min":"","max":"","suffix":"","prefix":"","decimalsymbol":".","groupingsymbol":"","readonly":true,"currency":false,"noEvalIfManual":true,"formatDynamically":false,"dynamicEval":true,"hidefield":false,"validate":false,"fBuild":{},"parent":""},{"dependencies":[{"rule":"","complex":false,"fields":[""]}],"form_identifier":"","name":"fieldname12","shortlabel":"","index":10,"ftype":"fCalculated","userhelp":"","audiotutorial":"","userhelpTooltip":false,"tooltipIcon":false,"csslayout":"","title":"Rate OT untuk 1.5","predefined":"","required":false,"exclude":false,"size":"small","eq":"(fieldname2\/fieldname21)\/fieldname22*1.5","min":"","max":"","suffix":"","prefix":"","decimalsymbol":".","groupingsymbol":"","readonly":true,"currency":false,"noEvalIfManual":true,"formatDynamically":false,"dynamicEval":true,"hidefield":false,"validate":false,"fBuild":{},"parent":""},{"dependencies":[{"rule":"","complex":false,"fields":[""]}],"form_identifier":"","name":"fieldname13","shortlabel":"","index":11,"ftype":"fCalculated","userhelp":"","audiotutorial":"","userhelpTooltip":false,"tooltipIcon":false,"csslayout":"","title":"Rate OT untuk 2.0","predefined":"","required":false,"exclude":false,"size":"small","eq":"(fieldname2\/fieldname21)\/fieldname22*2.0","min":"","max":"","suffix":"","prefix":"","decimalsymbol":".","groupingsymbol":"","readonly":true,"currency":false,"noEvalIfManual":true,"formatDynamically":false,"dynamicEval":true,"hidefield":false,"validate":false,"fBuild":{},"parent":""},{"dependencies":[{"rule":"","complex":false,"fields":[""]}],"form_identifier":"","name":"fieldname14","shortlabel":"","index":12,"ftype":"fCalculated","userhelp":"","audiotutorial":"","userhelpTooltip":false,"tooltipIcon":false,"csslayout":"","title":"Rate OT untuk 3.0","predefined":"","required":false,"exclude":false,"size":"small","eq":"(fieldname2\/fieldname21)\/fieldname22*3.0","min":"","max":"","suffix":"","prefix":"","decimalsymbol":".","groupingsymbol":"","readonly":true,"currency":false,"noEvalIfManual":true,"formatDynamically":false,"dynamicEval":true,"hidefield":false,"validate":false,"fBuild":{},"parent":""},{"form_identifier":"","name":"fieldname6","shortlabel":"","index":13,"ftype":"fSectionBreak","userhelp":"","audiotutorial":"","userhelpTooltip":false,"tooltipIcon":false,"csslayout":"","title":"Isi tempat kosong bawah berapa jam anda OT","fBuild":{},"parent":""},{"form_identifier":"","name":"fieldname23","shortlabel":"","index":14,"ftype":"fnumber","userhelp":"","audiotutorial":"","userhelpTooltip":false,"tooltipIcon":false,"csslayout":"","title":"Untuk OT rate 1.0","predefined":"","predefinedClick":false,"required":false,"exclude":false,"readonly":false,"numberpad":false,"spinner":false,"size":"small","prefix":"","postfix":"","thousandSeparator":"","decimalSymbol":".","min":"","max":"","step":"","formatDynamically":false,"dformat":"digits","formats":["digits","number","percent"],"fBuild":{},"parent":""},{"form_identifier":"","name":"fieldname15","shortlabel":"","index":15,"ftype":"fnumber","userhelp":"","audiotutorial":"","userhelpTooltip":false,"tooltipIcon":false,"csslayout":"","title":"Untuk OT rate 1.5","predefined":"","predefinedClick":false,"required":false,"exclude":false,"readonly":false,"numberpad":false,"spinner":false,"size":"small","prefix":"","postfix":"","thousandSeparator":"","decimalSymbol":".","min":"","max":"","step":"","formatDynamically":false,"dformat":"digits","formats":["digits","number","percent"],"fBuild":{},"parent":""},{"form_identifier":"","name":"fieldname16","shortlabel":"","index":16,"ftype":"fnumber","userhelp":"","audiotutorial":"","userhelpTooltip":false,"tooltipIcon":false,"csslayout":"","title":"Untuk OT rate 2.0","predefined":"","predefinedClick":false,"required":false,"exclude":false,"readonly":false,"numberpad":false,"spinner":false,"size":"small","prefix":"","postfix":"","thousandSeparator":"","decimalSymbol":".","min":"","max":"","step":"","formatDynamically":false,"dformat":"digits","formats":["digits","number","percent"],"fBuild":{},"parent":""},{"form_identifier":"","name":"fieldname17","shortlabel":"","index":17,"ftype":"fnumber","userhelp":"","audiotutorial":"","userhelpTooltip":false,"tooltipIcon":false,"csslayout":"","title":"Untuk OT rate 3.0","predefined":"","predefinedClick":false,"required":false,"exclude":false,"readonly":false,"numberpad":false,"spinner":false,"size":"small","prefix":"","postfix":"","thousandSeparator":"","decimalSymbol":".","min":"","max":"","step":"","formatDynamically":false,"dformat":"digits","formats":["digits","number","percent"],"fBuild":{},"parent":""},{"dependencies":[{"rule":"","complex":false,"fields":[""]}],"form_identifier":"","name":"fieldname20","shortlabel":"","index":18,"ftype":"fCalculated","userhelp":"","audiotutorial":"","userhelpTooltip":false,"tooltipIcon":false,"csslayout":"","title":"Total Overtime Earning","predefined":"","required":false,"exclude":false,"size":"medium","eq":"(fieldname15*fieldname12)+(fieldname16*fieldname13)+(fieldname14*fieldname17)+(fieldname23*fieldname9)","min":"","max":"","suffix":"","prefix":"","decimalsymbol":".","groupingsymbol":"","readonly":true,"currency":false,"noEvalIfManual":true,"formatDynamically":false,"dynamicEval":true,"hidefield":false,"validate":false,"fBuild":{},"parent":""},{"form_identifier":"","name":"fieldname18","shortlabel":"Monthly Salary + OT - KWSP - Socso","index":19,"ftype":"fSectionBreak","userhelp":"","audiotutorial":"","userhelpTooltip":false,"tooltipIcon":false,"csslayout":"","title":"Monthly Salary + OT - KWSP = ","fBuild":{},"parent":""},{"dependencies":[{"rule":"","complex":false,"fields":[""]}],"form_identifier":"","name":"fieldname19","shortlabel":"","index":20,"ftype":"fCalculated","userhelp":"","audiotutorial":"","userhelpTooltip":false,"tooltipIcon":false,"csslayout":"","title":"Total Salary ( termasuk OT )","predefined":"","required":false,"exclude":false,"size":"medium","eq":"(fieldname2+fieldname3+fieldname20)-fieldname5*(fieldname2+fieldname3+fieldname20)","min":"","max":"","suffix":"","prefix":"","decimalsymbol":".","groupingsymbol":"","readonly":true,"currency":false,"noEvalIfManual":true,"formatDynamically":false,"dynamicEval":true,"hidefield":false,"validate":false,"fBuild":{},"parent":""},{"form_identifier":"","name":"fieldname26","shortlabel":"Monthly Salary + OT - KWSP - Socso","index":21,"ftype":"fSectionBreak","userhelp":"","audiotutorial":"","userhelpTooltip":false,"tooltipIcon":false,"csslayout":"","title":"EPF Details","fBuild":{},"parent":""},{"dependencies":[{"rule":"","complex":false,"fields":[""]}],"form_identifier":"","name":"fieldname24","shortlabel":"","index":22,"ftype":"fCalculated","userhelp":"","audiotutorial":"","userhelpTooltip":false,"tooltipIcon":false,"csslayout":"","title":"Employee EPF Sum ( 8% or 11% )","predefined":"","required":false,"exclude":false,"size":"medium","eq":"fieldname5*(fieldname2+fieldname3+fieldname20)","min":"","max":"","suffix":"","prefix":"","decimalsymbol":".","groupingsymbol":"","readonly":true,"currency":false,"noEvalIfManual":true,"formatDynamically":false,"dynamicEval":true,"hidefield":false,"validate":false,"fBuild":{},"parent":""},{"dependencies":[{"rule":"","complex":false,"fields":[""]}],"form_identifier":"","name":"fieldname25","shortlabel":"","index":23,"ftype":"fCalculated","userhelp":"","audiotutorial":"","userhelpTooltip":false,"tooltipIcon":false,"csslayout":"","title":"Employer EPF Sum ( 12% )","predefined":"","required":false,"exclude":false,"size":"medium","eq":"12*(fieldname2+fieldname3+fieldname20)\/100","min":"","max":"","suffix":"","prefix":"","decimalsymbol":".","groupingsymbol":"","readonly":true,"currency":false,"noEvalIfManual":true,"formatDynamically":false,"dynamicEval":true,"hidefield":false,"validate":false,"fBuild":{},"parent":""},{"dependencies":[{"rule":"","complex":false,"fields":[""]}],"form_identifier":"","name":"fieldname27","shortlabel":"","index":24,"ftype":"fCalculated","userhelp":"","audiotutorial":"","userhelpTooltip":false,"tooltipIcon":false,"csslayout":"","title":"Total EPF Contribution","predefined":"","required":false,"exclude":false,"size":"medium","eq":"fieldname24+fieldname25","min":"","max":"","suffix":"","prefix":"","decimalsymbol":".","groupingsymbol":"","readonly":true,"currency":false,"noEvalIfManual":true,"formatDynamically":false,"dynamicEval":true,"hidefield":false,"validate":false,"fBuild":{},"parent":""}],{"0":{"title":"Kalkulator Kira Gaji + OT","description":"Pastikan masuk butiran yang betul ya. Baca instructions","formlayout":"top_aligned","formtemplate":"cp_cff_natural","evalequations":1,"evalequationsevent":2,"autocomplete":1,"persistence":1,"customstyles":"","evalequations_delay":0,"direction":"ltr","loading_animation":0,"animate_form":0,"animation_effect":"fade"},"formid":"cp_calculatedfieldsf_pform_1"}];

|

Panjangkan kalkulator ni. Ya, terlampau panjang. Sebab saya tak tahu coding untuk buatkan dia jadi pendek, atau guna side sebelah kanan. So semua butiran yang anda isi berada di sebelah kiri. Kalau saya isikan juga disebelah kanan tak ada lah nampak panjang gini kan.

Calculator ini juga, baru sahaja saya edit hari ni, 9 September 2023. Sebab saya rasa macam ada yang tersalah kira untuk sebelum ni. Tapi tak apa, sekrang sudah OK, tapi bukan paling tepat ya. Anggap calculator ini anggaran sahaja.

Dalam calculator yang saya baru edit hari ini juga saya dah buangkan penolakan untuk socso, sebab socso ni sebulan memang tak banyak pun akan ditolak. So ia tak akan jejaskan sangat total net income gaji yang kita akan dapat nanti.

Cara Nak Guna?

Berapa hari anda bekerja dalam sebulan – kalau memang kerja isnin sampai jumaat. Mungkin dalam 26 hari sebulan. Kalau shift, macam saya dulu, mungkin 20 hari sahaja sebulan. Saya juga pernah kerja shift 16 hari sahaja sebulan.

So drag sahaja slider tu kepada berapa hari.

Jumlah Jam Bekerja – kalau anda shift, drag slider ke 12 jam. Kalau office hour, drag kepada 8 jam. Atau ada juga yang kerja shift 8 jam sehari kan!

Basic Salary dan Elaun – untuk basic salary self explanatory. Anda isi sahaja berapa basic yang dapat. Kemudian untuk bahagian elaun, pastikan anda tambah semua elaun telefon, transport, shift semua kalau ada. Tambah semua dulu ya. baru ISI.

KWSP – pilih skim yang mana satu, kalau tak ada. pilih tiada sahaja.

Monthly Salary ( Tiada OT ) – ini adalah jumlah selepas tolak sekali dengan socso. Socso ni tak banyak. Macam saya, bila basic 1740 pun. Socso potongan dalam 14 ringgit ja. So dalam formula ni, saya ambil total deduction socso dalam 0.5% sahaja daripada basic.

Saya pun tak pasti berapa sepatutnya yang akan ditolak. tembak ja 0.5% tu

Pengiraan Jumlah OT ( auto calculate ) – Kalau anda kerja ada OT. boleh teruskan lagi isi ruang dibawah. Kalau tak. rasanya pengiraan sampai Monthly Salary Tiada OT sudah selesai. Untuk ruangan ni, sebenarnya note untuk saya program kalkulator ni untuk tolak or tambah, or darab or bahagi di bawah nya. Tapi kalau anda nak noted untuk berapa gaji anda bagi rate 1.5 or 2.0 boleh juga.

Bila kerja kilang terutamanya, memang akan ada rate OT yang 1.5, Off day namanya.

Atau macam saya dahulu, kalau rest day dapat 2.0. Kalau kerja public dapat 3.0

Isi tempat kosong bawah berapa jam anda OT – seterusnya, untuk ruangan terakhir di bawah.

Anda mesti isi dalam unit jam ya. Contoh kerja 1 hari untuk shift 12 jam. Jangan tulis 1 sahaja. Sebab unit itu dalam jam. Jadi anda tulis 12 jam. Contoh macam saya tulis di atas, 60 jam

Dan terakhir…

Selesai!!

Adakah pengiraan saya tepat? Sudah pasti tidak. Sebab setiap tempat kerja memang lain polisi dan cara kiranya. Cuma untuk diatas yang saya buatkan untuk anda ni adalah yang general. Atau kebiasaannya.

Untuk faham lebih detail, macam mana saya come out dengan formula kalkulator di atas. Anda boleh cuba cuba penerangan untuk pengiraan di bawah ya.

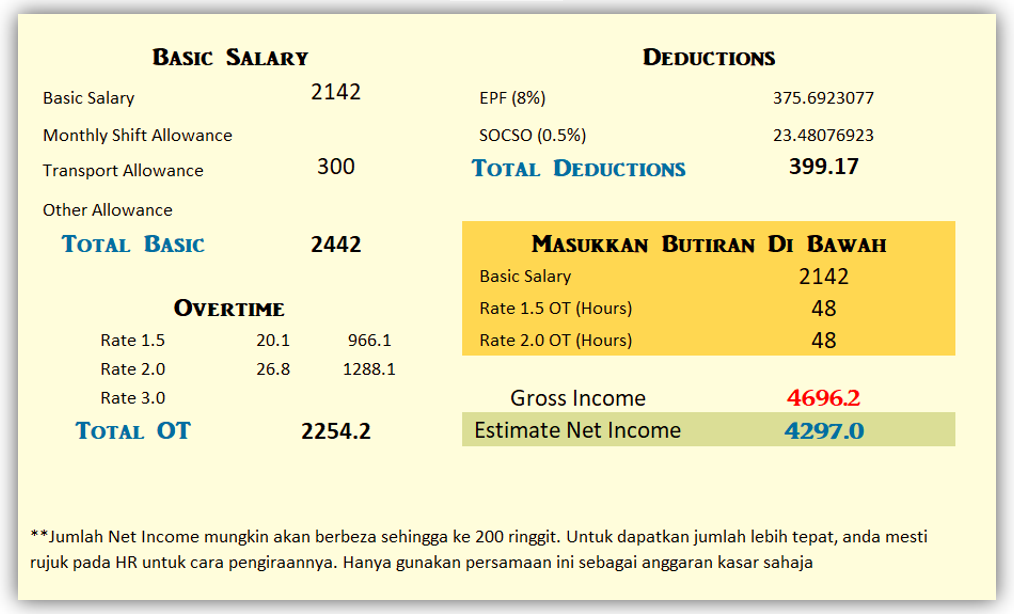

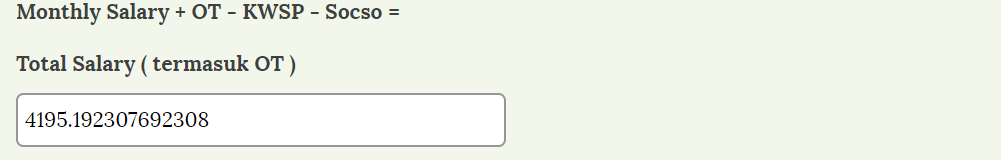

*pengiraan dibawah ini adalah hasil daripada penulisan saya yang lepas. Kira tahun 2018 lagi rasanya. Dan bila saya cuba cuba semula dengan kalkulator yang di atas ni. Jumlahnya lebih kurang sama.

beza dengan socso sahaja. Sebab saya terlupa nak tolong socso. Itu sebab dapat RM 1749.02

Dan Penerangannya..

Mula mula kita kira berapa OT untuk satu jam.

( Basic / 26 hari ) bahagi ( 8 jam ) = Gaji Untuk 1 jam

1 jam ini pula darab dengan 1.5 sebab itu normal rate. Macam kilang saya ada yang 2.0, ada yang 3.0 pun. 2.0 ni biasa public lah, dia akan kira double.

So untuk pengiraan di atas.

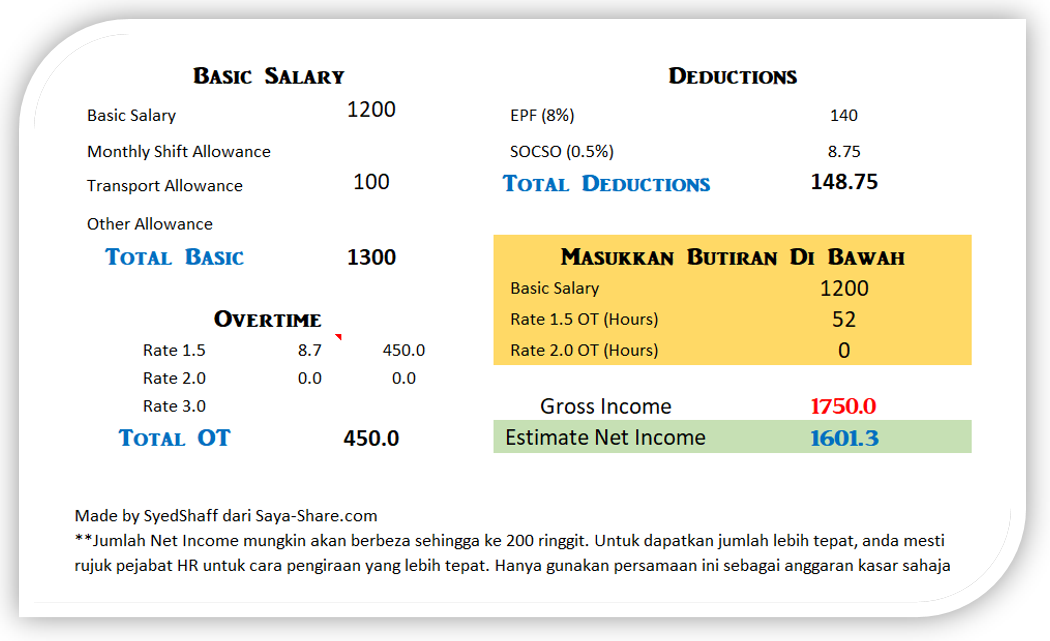

( 1200 / 26 ) bahagi ( 8 jam ) = RM 5.769 <<< ini adalah jumlah GAJI Untuk 1 Jam

Sekarang, saya akan darab dengan 1.5 untuk tahu berapa pula gaji dikira kalau OT dalam 1 jam, untuk rate 1.5

Maka, RM 5.769 x 1.5 = RM 8.635 ( ini adalah rate OT untuk satu jam )

Tadi rate OT di atas ada 2 jam untuk satu hari kan?

So dalam sebulan, ada 26 hari bekerja. Dalam 26 hari bekerja akan ada 52 jam ot (26 hari x 2 jam)

52 jam OT x rate OT 1.5 = 52 x RM 8.635 = RM 449.02 ( ini jumlah OT sebulan )

Dan total nya

Basic + OT + elaun = Gross Income…

RM 1200 + Rm 449.02 + RM 100 (elaun) = RM 1749.02

Persamaan excel yang saya buat dibawah juga dapat lebih kurang sama. Iaitu RM 1601.3. Kira tak jauh sangat beza dengan kalkulator di atas, Sebab bila saya kira guna butiran di yang sama. monthly last akan jadi RM 1612.

Kiranya, saya nak bagi tahu. Kalkulator yang saya buat di atas, rasanya dah betul sangatlah kan. Cuma kalau ada yang rasa macam salah, minta bagi tahu di komen ya. Saya perlukan feedback anda.

Cara Kira Gaji Saya Pula

Macam saya cakap tadi, setiap kilang atau company tu memang berbeza cara kiranya. Dan masa saya kerja di Kedah. Dalam tahun 2016 hingga 2019. Memang tak akan dapat kalau guna kalkulator di atas tadi.

Sebab memang berbeza. Saya dah berhenti kerja yang sekarang, sebab dah focus perniagaan sendiri.

Berikut, adalah cara kira gaji semasa saya kerja di kilang Kedah. Lain sikit caranya.

Begini

( Basic + Elaun ) x 12/2184 = Kadar OT Satu Jam

Lepas tu darab macam biasa dengan 1.5 atau 2.0 ikut pada hari saya bekerja.

Seperti contoh.

Basic saya RM 2k

[( RM 2000 + RM 340 ) x 12 ] / 2184) = RM 12.857 (untuk rate 1 jam)

Darab 1.5 akan jadi: RM 19.28

Kebiasaannya, saya akan target OT 80 jam.

So 19.28 x 80 = RM 1542

Maka

RM 2000 + RM 340 + RM 1542 = RM 3882.00

Oh ya, minus 11 percent ya untuk KWSP.

RM 3882.00 ini baru saya kira kalau kesemua 80 jam yang saya OT adalah rate untuk 1.5. kebiasaanya, rate 2.0 akan ada lebih kurang dalam 30%. Bergantung juga. Tapi lebih kurang dalam 30%.

Sekarang saya ambil kira kalau 30 jam adalah rate 2.0. selebihnya 50 jam adalah untuk 1.5

Rate untuk 1.5 = RM 19.28

Rate untuk 2.0 = RM 12.857 x 2.0 = RM 25.714

Makanya….

25.714 x 30 = RM 771.42

19.28 x 50 = RM 964

Total: RM 1735.42 ( baru jumlah OT )

Dan totalnya,

RM 2000 + RM 340 + RM 1735 = RM 4075 (nanti tolak 11% sendiri)

Dan untuk basic gaji RM 1000 pula

Untuk anda yang gaji RM 1000, berapa pula jumlah OT ialah, anda perlukan maklumat di bawah.

- Basic berapa: RM 1000 lah kan

- Jumlah OT berapa

- Elaun berapa

- Elaun tambahan berapa, maksud saya begini. Contoh macam saya sendiri, elaun setiap bulan memang sudah dalam RM 300. Tapi kalau saya OT pada waktu malam, akan tambah RM 15.

Dan buat lah seperti pengiraan di atas.

Berapa Banyak Boleh Dapat Bila OT?

Untuk kira gaji ini, kalau ikutkan pengalaman saya, mula mula saya pun tak perasan benda ni. Kawan yang cakap dulu. Ialah, jumlah OT hanya akan ambil separuh daripada jumlah gaji pokok.

Bermaksud, kalau basic RM 1000

Biasanya total gaji anda kalau buat OT, akan jadi RM 1500

Sebelum ini saya pernah gaji RM 1500, anda boleh baca pengalaman kerja saya disini.

Dan bila di campur OT, akan jadi lebih kurang RM 1500 + ( separuh gaji ) = RM 2 250

Tapi masa tu saya OT kuat juga, so gaji saya lebih kurang dalam RM 2500.

Tapi memang tidak pernah sampai RM 3k

Bagaimana pula dengan basic RM 2000 yang saya kira di atas tadi.

Sepatutnya tak lebih RM 3000 kan?

Kenapa boleh sampai RM 4k?

Sebab kerja kilang. Memang tersangat bergantung kepada benefit yang company bagi.

Contoh, macam kilang saya ada 3 jenis bonus. Salah satu nya ialah profit sharing. Profit sharing ini maksudnya company akan bagi bonus setiap 3 bulan. Percentage lebih kurang dalam 0.3 percent daripada basic.

RM 4075 di atas adalah bulan biasa, tidak termasuk profit sharing setiap 3 bulan.

Contoh katakan kena pula pada bulan yang ada profit sharing.

Pengiraan gaji adalah lebih kurang seperti di bawah.

0.3 x RM 2000 = RM 600 ( hasil dari bonus )

Makanya lagi…

RM 4075 + RM 600 = RM 4675

Selesai…

Harap anda jelas dengan cara pengiraaan gaji. Untuk pengiraan gaji kerja kerajaan saya tak pernah terpikir nak tahu pula. Walaupun, wife, kakak, adik, abng saya kerja dengan kerajaan. Sekarang jam 12.08 am, 13 September 2020. Wife pun dah ngantuk.

Nanti bila dia dah segar, saya akan cuba mintak payslip dia untuk guna kalkulator kita ni.

Biar dia tidor dulu. Nanti merajuk pula kan.

Apa apa pun, sebarang feedback ataupun penambahbaikan, sangat sangat dialu alukan ya.

Kalau ada yang boleh share saya payslip anda pun ok. Boleh saya matchkan dengan kalkulator kira gaji ni.

Assalamualaikum.